Introduction

Diversification refers to the ancient adage of “don’t put all your eggs in one basket.”

This advice may be applied to almost every situation in life. Don’t pack all of your underpants in your checked baggage if you’re traveling. If your baggage is missing, have an extra pair in your carry-on.

Don’t only purchase apples when you go grocery shopping. Even though “one apple a day keeps the doctor away,” you still need the nutrients found in other fruits and vegetables.

Diversification of investments may be accomplished in a variety of ways. Different financial assets, such as stocks, bonds, foreign currency (FX), and so on, may be used to diversify your portfolio.

Diversify your portfolio by industry, such as technology, healthcare, and entertainment. Multiple investing time periods, both short-term and long-term, may help you manage your money. Including cryptocurrency in your investing portfolio is simply a means of balancing it.

Because the cryptocurrency market is so unlike from conventional ones, diversification may help you maximise the growth potential of your portfolio. The cryptocurrency market may respond differently to numerous geopolitical and financial events, which is one of the key reasons for this larger potential.

In the parts that follow, I explain further by quickly examining various conventional markets and comparing them to the bitcoin market.

Stocks as an investment

The stock market allows you to participate in a portion of a company’s earnings. You become a part-owner of the corporation by purchasing its shares. The greater your share of the cake, the more stocks you purchase.

Of course, the larger the danger, the more likely it is that the whole cake will be thrown out.

One of the most enticing investing assets is the stock market. Novice investors could buy one or two stocks just because they like the firm. The allure of stock investment for most investors is the chance that prices would rise over time, resulting in considerable cash gains.

Dividends, which are paid out on a regular basis by select companies, may offer you with a regular income stream.

Regardless, the dividends paid within a year for most companies are insignificant when compared to the rise in the stock’s value, particularly when the economy is doing well.

Stocks and cryptocurrencies have exactly the same thing in common: You might expect to gain from price appreciation when their individual markets are robust.

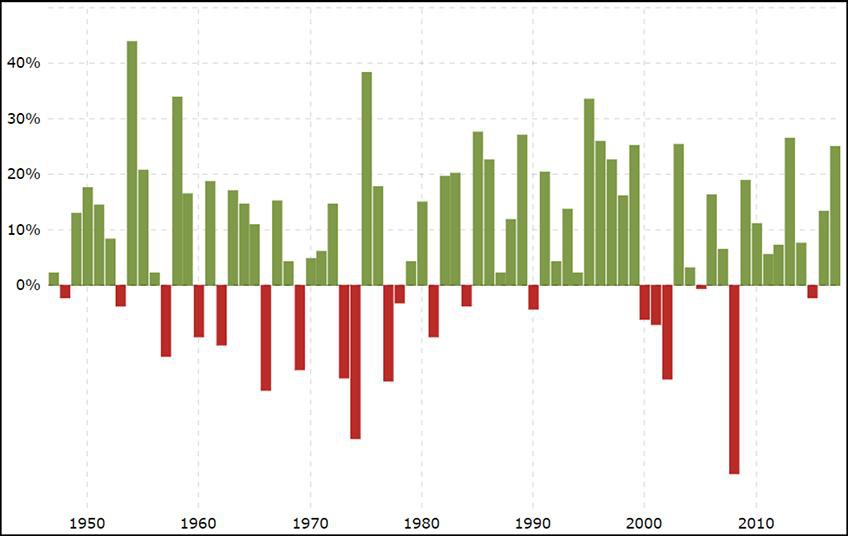

But make no mistake: both markets have their awful days and even poor years. The stock market has a longer track record, which may help investors navigate the future.

Year-by-year chart of the Dow Jones Industrial Average for the last 70 years

Source: Macrotrends.net

Stocks are exposed to a variety of hazards. Even the most fantastic stocks come with hazards that are difficult to avoid, such as the following:

- Financial and business risk

- Risk of losing purchasing power

- Market danger

- The possibility of an occurrence

- Control and restrictions by the government

- Competition from abroad

- The status of the economy in general

- The process of stock selection might be a pain in the neck.

There are literally hundreds of stocks from which to pick. It’s also tough to predict how the firm will do tomorrow. After all, the present price merely reflects the company’s current status or what market players believe it to be.

You may be able to mitigate some of the above risks by investing in the bitcoin market. The selecting procedure for cryptocurrencies is likewise distinct from that for stocks.

However, the eventual drawback of stock investment is comparable to that of crypto investing. They both provide less immediate income than some other investments. Several forms of investments, such as bonds (which I explain in the next section), offer higher current income with more predictability.

Investing in cryptocurrencies is asymmetric. Cryptocurrency investments, when done correctly, may provide a huge profit (ROI). Since their first coin offers, NXT has a 697,295 percent ROI, Ethereum has a 160,100 percent ROI, and IOTA has a 282,300 percent ROI. There isn’t a single other investment that compares. Netflix is the best-performing stock, with a ten-year return of roughly 64,000 percent!

Bonds Investment

Fixed-income securities are another name for bonds. They vary from cryptocurrency and equities in that you lend money to an entity for a certain length of time in exchange for a predetermined amount of interest. As a result, it’s classified as “fixed income.”

Bonds, like cryptocurrency and equities (see the previous section), are expected to generate capital gains. These capital gains, on the other hand, function a little differently. Bond prices do not normally grow in tandem with a company’s earnings since corporations issuing bonds commit to repay a specified amount when the bonds expire. Bond prices fluctuate in response to changes in market interest rates.

Bonds, cryptocurrency, and stocks all have one thing in common: they’re all issued by a variety of firms. Moreover, numerous government agencies issue bonds. If you merely want to diversify your bonds portfolio, you may select from a variety of moderately safe to very risky options.

Bonds are often less hazardous and deliver better current income than cryptocurrency and equities. They are, nevertheless, nonetheless vulnerable to a range of dangers. Bond investment has some of the same dangers as cryptocurrency and equities, such as buying power risk, business and financial risk, and liquidity risk.

The call risk, also known as prepayment risk, is a form of risk that applies to bonds. The chance of a bond being called, or retired, before its maturity date is known as call risk. You’ll have to find a new home for your money if the bond issuer calls the bonds.

When compared to cryptocurrencies and equities, the possibility for really large profits on bonds is substantially smaller. Bonds, on the other hand, have a smaller risk than stocks.

Forex Investment

Here’s an alternative to cryptocurrency that might be even riskier. The foreign exchange market is referred to as forex by nerds. It was the very first item I ever put money into.

You may purchase and sell currencies by engaging in the forex market. Not cryptocurrencies, but fiat currencies like the US dollar, euro, pound sterling, Australian dollar, or any other money issued by any government. A fiat currency is the government-issued legal money of a nation.

Most people linked cryptocurrencies like Bitcoin with the conventional FX market before Bitcoin became the celebrity of financial assets in 2017, since “cryptocurrency” incorporates the term “currency,” and crypto owners planned to use their assets to make payments. Cryptocurrencies, on the other hand, have a lot in common with equities, When you invest in the forex market, you aren’t always looking for long-term monetary gains. Even the most widely used currencies, such as the US dollar, are very volatile throughout the year. A strong dollar does not automatically imply a thriving economy in the United States.

Because they depend largely on exports, certain nations, such as Japan, want to have a weaker currency. They obtain a cheaper rate to sell the identical product internationally than they do domestically if their currencies are stronger than the currency of the country they’re attempting to sell to.

As an investor, short-to-medium-term trading activity between various currency pairings is the most common way to participate in the forex market. For example, you may purchase the euro against the US dollar (the EUR/USD pair). You profit if the euro’s value rises in relation to the US dollar’s. However, if the value of the US dollar rises above that of the euro, you will lose money.

When it comes to stock and cryptocurrency research, the FX market requires a fundamentally different strategy. When studying the forex markets, you should concentrate on the economic state of the issuing country, as well as upcoming economic figures such as the country’s gross domestic product (GDP, or the value of goods produced within the country), unemployment rate, inflation, interest rate, and so on, as well as the political environment.

You must, however, trade forex in pairs, just as you do in the cryptocurrency market. I equate these pairings to dance partners – multinational couples who push each other back and forth — in my online forex education course, the Forex Coffee Break. Traders might profit by betting on which way the pair will go next.

A similar principle may be used to the bitcoin market. You may pit Bitcoin (BTC) and Ethereum (ETH) against each other, for example. You may even trade a cryptocurrency like Bitcoin for a fiat currency like the US dollar in order to speculate on their value.

However, in these circumstances, you must examine each currency independently, whether crypto or fiat. Then you must compare their respective values and forecast which currency will triumph in the couple’s future conflict.

Investing in Precious Metals

It’s time to compare one of the most recent man-made ways of purchasing goods (cryptocurrencies) to one of the oldest! No, I’m not returning to the days of bartering, when people traded products and services to meet their necessities. In the following sections, Precious metals like gold and silver were long used to manufacture coins and purchase things before the invention of paper money.

People used to barter for things that were of genuine worth to their human needs, such as poultry, clothing, or agricultural skills. People of Lydia’s ancient culture are said to have been among the first to utilise gold and silver coins to trade goods and services.

Consider the first consumer who attempted to persuade the vendor to take a gold coin instead of three chickens that would feed a household for a week. Leather money, paper money, credit cards, and now cryptocurrencies have all followed suit.

Some would claim that precious metals, such as gold, have inherent worth as well. They’re long-lasting. They have certain industrial use since they conduct both heat and electricity. Most individuals don’t invest in precious metals with the hopes of conducting electricity. They purchase them largely to use as jewellery or cash. The value of gold and silver nowadays is mostly determined by market sentiment.

Silver is more often used in industry than gold. Batteries, electrical gadgets, medical devices, and other industrial things all include silver. Despite the increased demand, silver is less valuable than gold. Silver, for example, is now trading around $16 per ounce, while gold is trading at over $1,250 per ounce.

Keep in mind that England did not use gold as its official currency until 1816. Through its Federal Reserve system, the United States ultimately joined in 1913. Its notes were gold-backed, and it attempted to assure that notes and checks were honoured and could be redeemed for gold.

Despite the fact that precious metals have no inherent worth, they have long been a popular investment strategy among traders. One of the key reasons is because they have a long history of being associated with riches.

People often flock to precious metals when their other assets, such as bonds, real estate, and the stock market, fall in value or the political climate becomes unstable. People like to possess precious metals during these times because they can physically touch them and store them next to their mattresses in their houses.

Precious Metals vs Cryptocurrencies

Aside from the fact that you have to mine precious metals and certain cryptocurrencies to get your hands on them, precious metals and cryptocurrencies have a lot in common, including the fact that they are both uncontrolled.

At different periods and in different locations, gold has been an uncontrolled money. When investors lose faith in the official currency, unregulated currencies become more valued, and cryptocurrencies seem to be another illustration of this tendency.

Investing in precious metals has a variety of risks that you should be aware of. If you’re purchasing actual precious metals as an investment, for example, you must consider the risk of mobility.

Because of their weight, hefty import duties, and the necessity for a high degree of security, transferring precious metals may be costly. Cryptocurrencies, on the other hand, do not need a physical transfer. Even with a hardware wallet, transferring cryptocurrency is significantly quicker and less costly than transferring precious metals.

Cryptocurrency values, on the other hand, have been more volatile than all precious metals combined in the short period they’ve been accessible on the market.

The market’s excitement contributed to the market’s volatility in 2017. Cryptocurrency prices may become more predictable as cryptocurrency investment becomes more common and more people use it for regular transactions.

Future investment trends

The lubricant that permits a machine to function is oil, and blockchain technology is the lubricant that allows the bitcoin market to function. Blockchain is the underlying technology powering cryptocurrencies, as well as one of those game-changing innovations that has the ability to totally transform practically every business on the planet.

Blockchain has a lot more potential since it aims to tackle many economic and financial issues in the world today, from addressing the inefficiencies of the sharing economy to banking the unbanked and underbanked.

Here are some of the types of social benefit that cryptocurrencies and blockchain technology may provide.

We live in a time when the sharing economy is on the rise. People may rent out their own property for others to use in the sharing economy. Internet behemoths like Google, Facebook, and Twitter depend on user contributions to produce value on their own platforms. You’re part of the sharing economy crowd if you’ve ever taken an Uber or Lyft instead of a cab or leased a room on Airbnb instead of a hotel.

The conventional sharing economy, on the other hand, has its flaws, such as the following:

Having to pay a lot of money to use the platforms.

Individual consumers are being harmed while the underlying firm benefits:

Most of the time, the value created by the crowd isn’t divided equitably among all those who participated to the value creation. The huge middlemen that run the platforms take all of the earnings.

Using customer data in a haphazard manner:

Some corporations have misused their position of power by gaining access to sensitive data without the knowledge of its clients.

As the sharing economy grows, its challenges will almost certainly get more difficult.

Several firms are creating blockchain-based sharing economy solutions to address these challenges. These systems are far less expensive to use and give much-needed openness. They reduce, and in some cases eliminate, the requirement for a centralised intermediary.

This move enables real peer-to-peer connections, removing the 20–30% transaction fees associated with centralised platforms. All users may audit the network’s functioning since all transactions are documented on blockchains.

The decentralised nature of blockchain technology allows for this approach, which is ultimately a way for people to organise shared activities, engage directly with one another, and govern themselves in a more trustworthy and decentralised manner.

There are certain bitcoin transactions that aren’t completely free. In many situations, you must pay “network fees,” which are payments due to the blockchain network members who are mining your coins/transactions, every time you make a transaction on the blockchain.

When you consider the time “wasted” waiting for a transaction to clear (for example, a Bitcoin transaction takes 78 minutes to achieve consensus), moving to certain blockchain apps may not save you any money in fees.

Blockchain will continue to power the economy of the future, with cryptocurrency serving as a byproduct for dispersing the global economy.

Hedging against Government Controlled Currency

Without the control of a central bank or monetary authority to ensure trust or market behaviour, Bitcoin and other cryptocurrencies grew to become a trillion-dollar asset class in 2017. Most cryptocurrencies, unlike fiat currencies like the US dollar and the euro, will never be subject to central bank money creation (formally known as quantitative easing). Most cryptocurrencies have a limited supply,

which implies they don’t create money. Even in circumstances when demand is great, networks restrict the supply of tokens. For example, the quantity of Bitcoin will decline over time, reaching its maximum level around the year 2140.

A timetable defined in the code controls the supply of tokens in all cryptocurrencies. In other words, the money supply of a cryptocurrency at any given time in the future can be determined approximately now.

The absence of government control over cryptocurrencies may also assist to reduce the danger of inflation. History has repeatedly shown that when a government implements terrible policies, gets corrupt, or faces a crisis, the country’s currency suffers.

The printing of extra money may be necessary as a result of the currency value volatility. Inflation is the reason why a gallon of milk cost less than a dollar while you have to pay at least three dollars. How fantastic would it be if cryptocurrency could eliminate government-controlled inflation, ensuring that your grandkids do not pay more for things than you do?

Unbanked and underbanked people may get help.

Banking the unbanked is one of the most noble issues that cryptocurrencies can tackle.

“2 billion people in the globe still don’t have a bank account,” according to Cointelegraph. The majority of them reside in low- and middle-income developing economies, but even in high-income nations, many individuals are unable to satisfy their basic financial demands via banks. This implies they are unable to benefit from the ease, security, and interest offered by banks.”

Furthermore, many individuals are underbanked, meaning they have a bank account but not enough access to the financial services that banks may provide. Even in 2015, 33.5 million households in the United States remained unbanked or underbanked. These individuals are unable to participate in the economic development cycle because they lack access to savings and credit.

Cryptocurrencies have the ability to assist the unbanked and underbanked by allowing them to develop their own financial alternatives in an efficient and transparent manner, thanks to blockchain technology. To begin sending and receiving money using cryptocurrencies such as Bitcoin, all that is required is a smartphone or laptop with an Internet connection.

Conclusion

Diversification refers to the ancient adage of “don’t put all your eggs in one basket”. Different financial assets, such as stocks, bonds, foreign currency, and so on, may be used to diversify your portfolio. Including cryptocurrency in your investing portfolio is simply a means of balancing it. You might expect to gain from price appreciation when their individual markets are robust. Cryptocurrency investments, when done correctly, may provide a huge profit (ROI).

Bonds, cryptocurrency, and stocks all have one thing in common: they’re all issued by a variety of firms. Bond prices fluctuate in response to changes in market interest rates. The chance of a bond being called, or retired, before its maturity date is known as call risk. As an investor, short-to-medium-term trading activity between various currency pairings is the most common way to participate in the forex market.

However, you must, however, trade forex in pairs, just as you do in the cryptocurrency market. Precious metals were long used to manufacture coins and purchase things before the invention of paper money. The value of gold and silver nowadays is mostly determined by market sentiment. People flock to precious metals when their other assets, such as bonds, real estate, and the stock market, fall in value. When investors lose faith in the official currency, unregulated currencies become more valued.

Cryptocurrency values have been more volatile than all precious metals combined. The market’s excitement contributed to the market’s volatility in 2017. Blockchain-based sharing economy solutions are less expensive to use and give much-needed openness. This move enables real peer-to-peer connections, removing the 20–30% transaction fees associated with centralised platforms. Most cryptocurrencies have a limited supply, which implies they don’t create money.

The absence of government control over cryptocurrencies may also assist to reduce the danger of inflation. Inflation is the reason why a gallon of milk cost less than a dollar while you have to pay at least three dollars. To begin sending and receiving money using cryptocurrencies such as Bitcoin, all that is required is a smartphone.

Disclaimer:

NO INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing on the Site constitutes professional and/or financial advice.